The Buzz on Dental Debt Collection

Facts About Dental Debt Collection Revealed

Table of ContentsFascination About Business Debt CollectionThe Debt Collection Agency PDFsDebt Collection Agency for BeginnersDebt Collection Agency - Questions

A financial debt enthusiast is a person or company that is in the organization of recouping cash owed on delinquent accounts. Several debt enthusiasts are employed by companies to which cash is owed by people, running for a flat cost or for a percent of the amount they are able to accumulate.A financial debt collection agency attempts to recover past-due financial debts owed to financial institutions. Some financial debt collection agencies purchase delinquent financial obligations from lenders at a discount rate and also after that look for to gather on their very own.

Debt collection agencies who violate the rules can be taken legal action against. At that point the debt is claimed to have actually gone to collections.

Overdue payments on credit scores card balances, phone costs, automobile finances, utility bills, as well as back taxes are instances of the overdue financial debts that a collection agency might be entrusted with fetching. Some business have their own debt collection divisions. A lot of locate it much easier to hire a financial obligation collector to go after overdue financial debts than to go after the clients themselves.

Not known Details About Dental Debt Collection

Financial debt collection agencies may call the individual's personal as well as work phones, as well as even show up on their front door. They might likewise contact their household, buddies, and neighbors in order to confirm the call information that they carry apply for the person. (Nevertheless, they are not enabled to disclose the reason they are trying to reach them.) Furthermore, they might mail the borrower late settlement notifications.

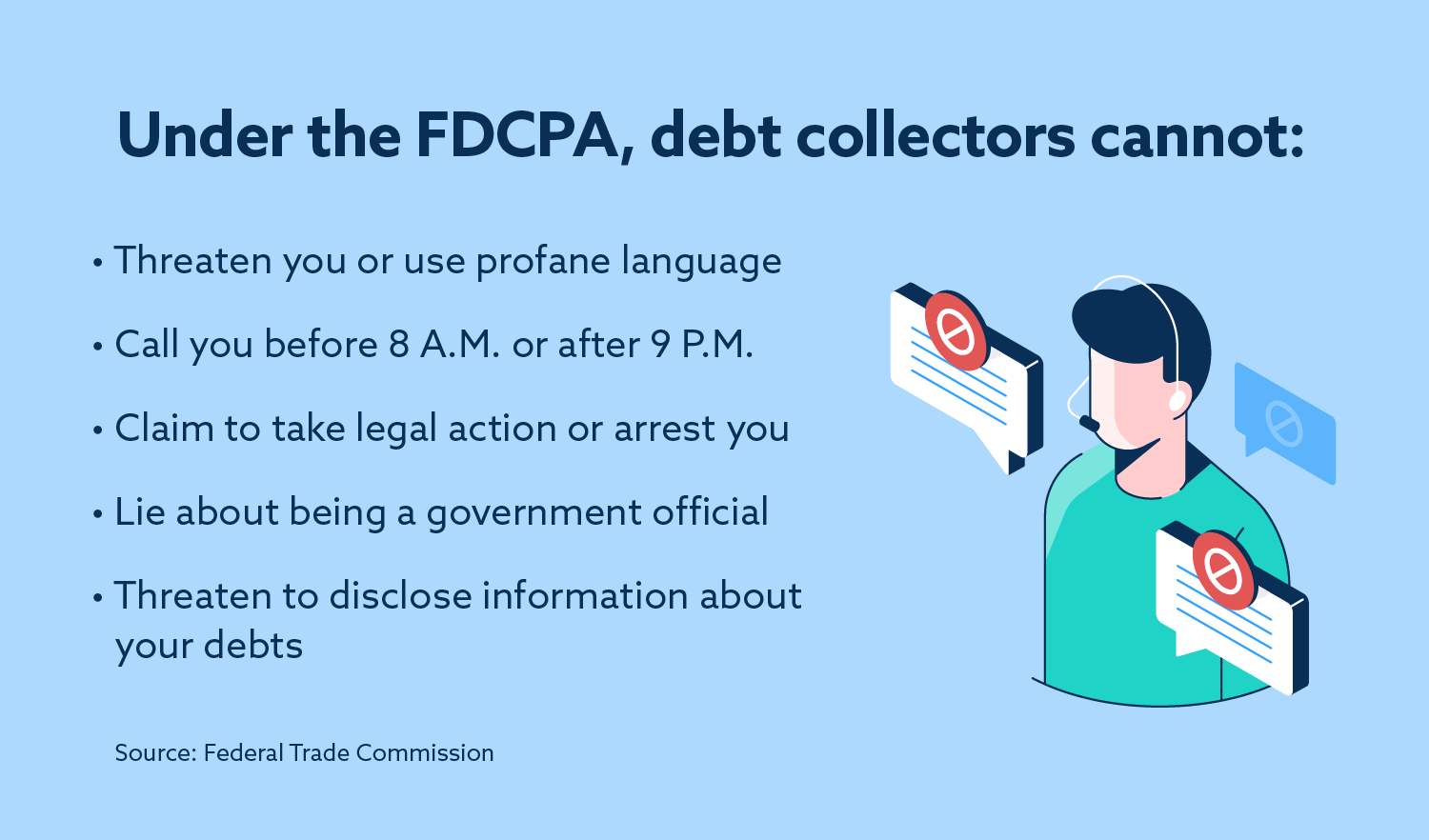

m. or after 9 p. m. Nor can they incorrectly declare that a debtor will certainly be jailed if they stop working to pay. Additionally, a collector can not literally harm or endanger a borrower as well as isn't enabled to seize assets without the authorization of a court. The legislation also provides debtors certain civil liberties.

Individuals who believe a financial obligation collection agency has actually damaged the law can report them to the FTC, the CFPB, and their state chief law officer's office. They additionally deserve to take legal action against the financial obligation enthusiast in state or federal court. Yes, a financial obligation collector may report a financial debt to the credit scores bureaus, yet just after it has actually spoken to the debtor regarding it.

Both can stay on credit history reports for approximately seven years and have an unfavorable effect on the individual's credit history, a large section of which is based on their payment background. No, the Fair Financial Debt Collection Practices Act uses just to consumer financial obligations, such as home mortgages, credit rating cards, vehicle loan, student finances, and clinical costs.

Not known Details About International Debt Collection

When that takes place, the IRS will send the taxpayer a main notice called a CP40. Since frauds prevail, Visit This Link taxpayers should watch out for anybody professing to be working with part of the internal revenue service and also check with the internal revenue service to make sure. That relies on the state. Some states have licensing needs for financial debt collectors, while others do not.

Debt enthusiasts offer a helpful solution to lending institutions and also other financial institutions that desire to recover all or part of cash that is owed to them. At the exact same time, the legislation supplies particular consumer protections important source to keep financial debt enthusiasts from ending up being too aggressive or violent.

Usually, this info is given in a written notification sent as the initial communication to you or within 5 days of their initial interaction with you, and it might be sent out by mail or electronically.

This notice generally needs to include: A statement that the interaction is from a financial obligation collector, Your name as well as mailing information, together with the name and mailing details of the financial debt collection agency, The name of the financial institution you owe the linked here debt to, It is possible that more than one lender will be noted, The account number associated with the debt (if any)An inventory of the current quantity of the financial obligation that mirrors interest, fees, repayments, and debts since a certain day, The existing amount of the debt when the notification is provided, Details you can use to reply to the debt collector, such as if you think the debt is not yours or if the quantity is wrong, An end date for a 30-day duration when you can dispute the financial debt, You might see other information on your notification, but the details noted above generally need to be consisted of.

The Ultimate Guide To International Debt Collection

Discover more concerning your financial obligation collection defenses..

State, you don't pay a charge card costs for several payment cycles. A representative of that card provider's collection division might connect to request payment. When a debt goes unpaid for a number of months, the initial financial institution will certainly typically offer it to an outside agency. The buyer is understood as a third-party financial debt collection agency."Debt collection agency" is an additional term utilized to describe third-party financial debt enthusiasts.

The FDCPA lawfully establishes what financial obligation collection agencies can and also can't do. For example, they have to inform you the amount of the debt owed, share info about your civil liberties and clarify just how to dispute the financial obligation. They can likewise sue you for payment on a debt as long as the law of limitations on it hasn't ended.